Hamilton is an Enlightened, classical liberal, a more consistent champion of rights and liberty than any other Founder, thus an inspiring model for contemporary friends of liberty.

Richard M Salsman

The Multiyear Decline in US Economic Freedom

Economic freedom in the world has plunged in recent years, due mainly to the interventions and fiscal-monetary profligacy associated with COVID shutdowns, mandates, and subsidies. The global measure is given in Figure One. This is a significant reversal of freedom’s...

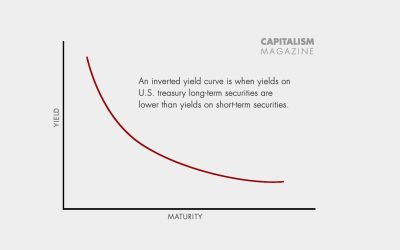

The Inverted Yield Curve and Next US Recession

Since the late 1960s US yield-curve inversions have predicted all eight US recessions, beginning roughly a year in advance.

Stocks and Bonds Hurt Alike Under Stagflation

When bonds and stocks decline a lot and simultaneously it suggests inflation is rising rapidly even as the economy is stagnating or contracting (or will soon do so). For most economists today, that combination is near-impossible.

Rent Selling Countries are More Corrupt and Less Wealthy

Cronyism isn’t a brand of capitalism, but a symptom of hybrid systems. The root problem of cronyism isn’t one of demanders who bribe, but of suppliers who extort.

The Impact of Higher Inflation on US Asset Class Returns

Central banking “independence” from politics (fiscal profligacy) seems to be a thing of the past.

A Tragic Half Century Without Gold Money

The gold standard wasn’t suspended because it caused the Great Depression or bank failures, nor did it disappear in 1971 because it “didn’t work.” It’s been gone because fiscal alchemists couldn’t expand the gold supply as they expanded government.

Lots of New Money, But Still-Low Inflation. What Gives?

Banks, businesses, and households tend not to hoard money in good times, or when they have confidence in the credibility and predictability of policymakers; they hoard in bad times, when they lack sufficient confidence. That is precisely the case today, even if officials won’t admit it.

Religious Left and Right Quibble Over Human Carnage, But Agree to Keep Hating Capitalism

For religious reasons, mainly, conservatives like Dennis Prager are unable to defend capitalism. They share more premises with socialists-fascists than they admit, yet rightly recognize them as fellow religionists.

Equity Performance Amid One-Party Rule in America

If history (especially more recent history) is a guide, U.S. equity gains over the next two years of full Democratic control will be inferior, a result that is more probable given that the party is currently more anti-business, anti-profit, and anti-capitalist than at any other time since 1970.

When Reason is Out, Violence is In

What explains today’s bi-partisan violence? When reason is out, persuasion and peaceful assembly-protest also are out. What remains is emotionalism – and violence.

Personal Liberty Sacrificed at the Altar of Covid Public Safety

If science had been followed in 2020 – in all fields – we’d be much healthier and wealthier than we now are. But control freaks have used Covid-19 to justify still more government controls, still more statism.

Ten Varieties of Anti-Capitalism

The ten varieties of anti-capitalism are anarchism, medievalism, nationalism, socialism, communism, fascism, populism, racism, environmentalism, and subjectivism.

Supposed “Varieties” of Capitalism

Does capitalism exist in “varieties,” as scholars began to insist two decades ago, or is it a unique social system fundamentally unlike all others? If there is a “pure” form of capitalism, what alterations or transformations render it impure? How impure must it become before we should cease calling it capitalism and call it something else instead?

Help Wanted: Price Gougers and Profiteers

Anti-price gouging laws are not only unjust, but to the extent they cause shortages in emergencies they also deprive people of things they need badly and would be willing to pay more for.

The Fallacy of “We”

The “we fallacy” is ubiquitous, especially among professors, politicians, policy wonks, and pundits. The fallacy of “we” is a form of the fallacy argumentum ad populum or “appeal to the people,” to “popular opinion.”

Supply-Side Panglossians are Not Objective

Capitalism (and economic analysis) requires reason, not faith, facts, not what feels good. The supply side is the right side, but the Pollyannas must cease their bias and at least try becoming more objective. They must defend the right policies, not merely those imposed by politicians they deem to be in the right because they are on the right.

Freedom Is Indivisible, Which Is Why All Types Are Now Eroding

The point of the principle of indivisibility is to remind us that the various freedoms rise or fall together, even if with various lags, even if some freedom, for a time, seems to be rising as others fall; in whatever direction the freedoms move, eventually they tend to dovetail.

Tripartite Governance: A Guidepost for Proper Policymaking

There are three main types of governance: public governance, private governance, and personal governance. Think of these as “the 3 Ps of governance.”

The Economy Needs Not Keynes or Kudlow But a Ventilator

Today it’s no mystery why non-sober Keynesians like Paul Krugman might love the demand-side, anti-capitalist, Trump-Kudlow policy mix, or why Trump foes might eagerly insist that the economy remain closed, not to preserve the nation’s health but to dissipate its wealth (and the probability of Trump’s re-election). But why would Trump do this? It seems politically suicidal.

Like this content? Subscribe to support our work — it's free.

Read by students, professors, and citizens, Capitalism Magazine provides over 9,000 free to read articles and essays from pro-reason, individual rights perspective. 100% independent.

No spam. Unsubscribe anytime.