There has been much debate amongst economists over the nature and usage of bitcoins. I recently wrote an article in which I briefly summarized the facts that give rise to the need for exchange and the necessary attributes of money, concluding that bitcoins will one day “go to zero” in terms of the gold price. In the wake of many good comments, this post is a follow-up to that post and elaborates my views on the nature of bitcoins.

First, it’s important to define a few terms related to the meaning of exchange and money. Following Reisman’s Capitalism, a “media of exchange” are goods “sought neither as articles of personal consumption nor as means of further production, but as means of effecting further exchanges.” Media of exchange can be just about anything including cigarettes, cattle, furs, etc. “The acceptability of the most preferred medium or media of exchange tends to go on increasing, until it or they are universally acceptable-i.e., have developed into money. Money is merely a medium of exchange whose use has grown to the point where it is directly and readily exchangeable against all other goods in a given geographical area.” As discussed in the previous post, precious metals became accepted as money due to their unique physical properties.

Another important concept when understanding the nature of bitcoins is “standard money.” Again quoting Reisman: “Standard money …is money that is not itself a claim to anything further. It possesses ultimate debt-paying power, in that when it is received no further claim to be paid is present. Under a gold standard, standard money is gold. Any paper money that exists is a claim to it.”

In a 2013 article, The Bitcoin Money Myth, Austrian economist Frank Shostak wrote: “Bitcoin is not a new form of money that replaces previous forms, but rather a new way of employing existent money in transactions. Because Bitcoin is not real money but merely a different way of employing existent fiat money, obviously it cannot replace it.” In other words, a bitcoin is not itself money, because it always relies on an actual form of money (standard money) to underlie it. To see this point, consider the following example. Most people are familiar with Western Union. It is a way to transfer money to someone in a different place. You can go to a Western Union office, give them a certain amount of cash, and someone in a different city can go to a Western Union office and get the money. Western Union provides a transferring function and you pay them a fee for their service.

Let’s say Western Union created tickets. One buys a ticket for say $100. He can then send the ticket to someone, rather than the $100 bill. The ticket is market “$100 payable on demand at any Western Union office.” When someone receives the ticket, he can take it to a Western Union office and get the $100 in cash. He may be able to trade the ticket to someone for a good or service because the recipient knows he can take the ticket to a Western Union office and get $100. The tickets in this instance represent transferable claims to standard money payable upon demand to the holders of the tickets.

The ticket is only valuable for three primary reasons. First, the ticket is redeemable for $100 in standard money (in this context, the $100 fiat currency is standard money). In other words, the Western Union tickets would have no value in and of themselves. Their value depends on the existence of, in this case, fiat currency or the $100. Second, the ticket is a legal obligation on behalf of the Western Union company to pay the ticket owner the $100 so that the bearer has a legal claim. Third, the dollar amount, $100 in this case, is known and not subject to change.

Bitcoin essentially provides a transfer function. Like the Western Union tickets, one buys a bitcoin for a certain price and the transaction is recorded. One can then send a bitcoin to another party to pay for a certain good or service if they are willing to accept it. With respect to this transfer function, Bitcoin employs sophisticated network technology and appears to be very good at transferring the coins securely and anonymously.

Like the Western Union example, when someone receives the bitcoin, the bitcoin is only valuable to the extent that someone can trade it for a good or can sell it to someone else for standard money. Again, as Shostak notes, its value depends on the existence of another form of money. However, unlike the Western Union example, no one is legally obligated to redeem a bitcoin for actual money, i.e., once you buy the bitcoin, no one has a legal obligation to accept it or redeem it, and consequently, the value of the bitcoin may change substantially in terms of actual money, potentially being worthless.

This is why, from an economics standpoint, bitcoins cannot replace actual money. Bitcoin is not money in and of itself. The bitcoin price is essentially the price of transferring already existent fiat currency or, in another sense, it is simply a non-binding “claim” to standard money. Since the value of bitcoins are not in their usage as standard money but in their usage in transactions, bitcoins are only as good as the fiat currencies in which they can be sold. In other words, since bitcoins are not redeemable in something physical, if fiat currency goes to zero, bitcoins will go to zero. Bitcoins may in fact go to zero even if fiat currency does not go to zero, if people just decide to stop using them for some reason. However, if fiat currency goes to zero, in terms of gold, what good is a bitcoin in its present form?

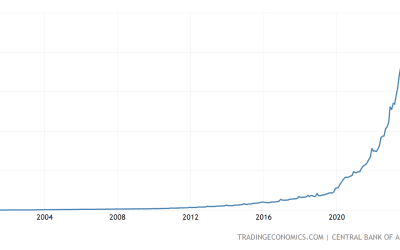

So why does anyone use bitcoin and what accounts for its popularity in some countries and industries? Merchants or individuals who accept bitcoins in foreign countries are betting that they can either exchange the bitcoins for something or cash them in for a more stable currency in the future as opposed to accepting local currency. This is a rational bet if you live in a country with a tyrannical government and/or an unstable currency. I would rather possess an anonymous potential claim to a valuable currency (in the form of a bitcoin) than possess a currency which is itself of little future value or obtained under monitoring from a government authority (Iran, China, etc.).

While bitcoins may serve a purpose and be of value in this and many other contexts, its actual nature, purpose and value should be better understood by potential buyers and sellers.