If you lived in a simple civil society, how would you survive? First, you’d have to do something – like make a tool, cut some wood, harvest some food, catch some fish, etc. Otherwise, you would just lay there and die.

If you wanted something from someone else, you would not go up to them and say “give me your stuff!” without starting a fight – remember, this is civil society. You would offer them something in exchange. From time to time, if you wanted to give something away or someone gave you something for nothing, fine, but that would be the exception, not the rule. If you keep asking for free stuff, that usually doesn’t go over very well. If you demand free stuff, it leads to fights and wars.

This brings us to a cardinal rule of economics, and life: there is no such thing as a free lunch. Someone has to do something in order to survive.

To go beyond mere survival, to flourish, people have to do even more work and succeed at living to such an extent that they can survive while spending time thinking, inventing, and producing. For example, if one guy figures out how to produce the same amount of food that used to take 10 guys, then the other 9 guys can work on other things besides food like inventing engines, spaceships, medicine, or computers to name a few. This is how human beings actually advance – how they live longer, healthier, and happier.

If you thoroughly understand and integrate this principle into your thinking, you will be able to detect about 90%-100% of the BS that flows from the modern economics profession. When a PhD or Federal Reserve official tells you that there is a magic way to create economic growth and prosperity without work or production, you will know something is wrong, even if he has a lot of formulas and pie charts.

When people begin advancing, it becomes a hassle to offer a random chicken or piece of wood in exchange for a carrot or some tobacco or whatever. What if you don’t have exactly what the other guy wants just then? What if you don’t want to carry a chicken around with you? It is much easier to offer a standard asset that is valuable to everyone all the time. If an asset has certain properties, it can serve as this asset. What are these properties?

First, the asset would have to be universally recognized as a value, i.e., just about everyone could find a use for it. It would be nice if it was found to be so valuable that a small amount would generally be accepted for just about anything. This way, you could carry it in your pocket instead of in a wagon. It would have to be something that could last a long time so you don’t have to worry about it vanishing. It would have to be divisible so you could cut it up into different sizes to correspond to other goods that have differing values. It would have to be something that does not change in value constantly due to dramatic changes in its supply. It would be best if the material was homogeneous, or the same throughout, so that people could agree easily on its value without having to evaluate it every time you want to trade.

For thousands of years, humans have chosen precious metals like gold and silver since they meet all of these criteria (see this for examples of gold’s practical uses). Again, these are not arbitrary criteria set by me or some government agency. They are criteria that follow from the nature of reality, i.e., the marketplace. This does not mean people shouldn’t barter good for good. It just means that using a standard asset is much easier most of the time, and people freely choose to use them since it makes trade and life easier and more productive. Quoting George Reisman (Capitalism, p. 142):

Thus, an economic system operating under the constraints of barter exchange would obviously offer only very limited opportunities, for division of labor and would thus be extremely primitive. In essence, to live in such an economic system, one would either have to be a farmer or produce the kinds of things that could be readily exchanged with farmers, such as blacksmithing services.

What is required for the existence of a division-of-labor society is the existence of money and monetary exchange. Money is a good readily acceptable in exchange by everyone in a given geographical area, and is sought for the purpose of being reexchanged.

So, the need for production and trade follows from man’s basic nature and the nature of the world in which we live. The exchange of value for value is a requirement of human life. The usage of barter or a standard asset such as precious metals in these exchanges is not arbitrary, it is an objective necessity of human survival. Money, such as gold and silver, is preferable to barter if you want to live a more productive, happier life. Due to their unique properties, precious metals have been the objective money choice of the market for thousands of years. Contrary to the claims of modern economists, gold and silver are not “barbarous relics” from a bygone age, but vital and necessary tools of exchange, which allow for an advanced division of labor economy and an increasing quality of life.

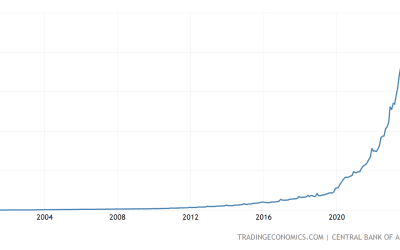

From the above, it can be seen that Bitcoin, a so-called digital currency, does not have these properties. A Bitcoin is not itself valuable as you can not make a wire or a bowl or bullets or a house out of Bitcoins like you could with metals. The only thing that makes Bitcoins temporarily valuable is the belief that someone else will accept them in exchange. In essence, Bitcoin is a like an even crappier fiat currency. It’s crappier, because at least fiat currency is legal tender, i.e., transactions are legally settled upon payment, and one must pay taxes in fiat currency. Bitcoin does not even have this property!

At some point, Bitcoin’s dollar value will go to zero as everyone who holds them tries to sell them to the next person and no one chooses to accept them. In fact, since dollars are fiat currency, their value will one day go to zero in terms of actually valuable goods for the same reason. Gold will never go to zero in terms of other commodities because of its special properties, like the fact that you can use it to do work and survive.

While many people express gold as a price in dollars, conceptually, it should be thought of in the reverse way. An ounce of gold is an ounce of gold and can always be exchanged into other commodities. Gold is the money. Any commodity price can be expressed in terms of a price in ounces of gold. Even the value of dollars or other fiat currencies and Bitcoins can be expressed in terms of gold. For now, at least, those prices are not yet zero.