The big online retailer Overstock.com now accepts payment in Bitcoin. That’s good news for lovers of liberty because Bitcoins give us an alternative to government-controlled money. Bitcoins are a currency created by anonymous, private tech nerds, not by government.

Governments don’t like competition, and our government sometimes bans competing currencies. But as more of us use Bitcoins, and more businesses accept payment in Bitcoin, it becomes harder for government to dismiss the currency as illegitimate, or ban it.

There are two advantages to Bitcoin.

First, it’s harder to trace transactions back to people who make trades. I don’t particularly care about that, because at the moment, I don’t hide anything from my government.

But I do fear government destroying the value of my dollars by printing more of them, the way governments in Germany before World War II and in Zimbabwe in recent decades did, forcing people to make trades using wheelbarrows of nearly worthless bills. Given how my government spends money, and the way the Fed enables this by buying trillions in government bonds, I fear my dollars may someday be worth pennies. So I bought Bitcoins.

Bitcoins are digitally created — or “mined” — at a slow, fairly predictable rate. An incomprehensible (incomprehensible to me, anyway) computer algorithm limits their number.

“Bitcoins are not controlled by anybody,” explained Mercatus Center senior research fellow Jerry Brito on my TV show. “It’s a new Internet protocol, like email or the Web … a digital, decentralized currency that allows you to exchange money with anybody in the world fast and cheaply without the use of a third party like PayPal or Visa or MasterCard.”

I bought Bitcoins even though I don’t understand how Bitcoin mining works. I also worry that someone will hack into my Bitcoin account and steal my money, or maybe hack into the whole system and devalue Bitcoins by creating millions of new ones.

But risky as this new currency may be, I still trust it more than I trust politicians. When my fellow baby boomers demand our promised Medicare payments and discover that government promised trillions more in benefits than it can ever pay for, I assume politicians will print dollars until they are nearly worthless.

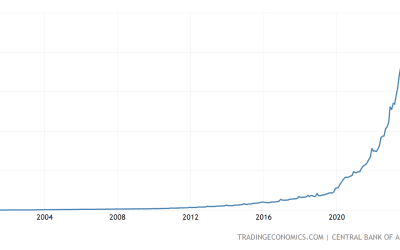

So, I put my savings into Bitcoins when they sold for $140 each. I was late to buy — smarter people bought for much less. But today each Bitcoin is worth more than $800. So, yippee for me! I’m so glad I put all my savings into Bitcoins.

OK, I didn’t really. It’s just part of my savings — but it’s good to hedge against political venality!

The biggest risk to private currencies may be that governments will become jealous of how well these upstart forms of money work. If people all over the world decide to trade in digital currencies, it will become more obvious than ever that government isn’t what makes economic activity happen.

It will also be harder to trace — and tax — people’s economic activity. Government doesn’t like to get sidelined. To its credit, the German government announced that it recognizes Bitcoin as a legal alternate currency.

The U.S. government flexed its muscles by warning that it has the right to regulate Bitcoin transactions. The FBI already shut down a website called Silk Road that accepted Bitcoins as pay for services both legal and illegal (like drugs). Sen. Chuck Schumer, D-N.Y., called Bitcoin “money laundering” and demanded a crackdown. That’s not surprising, since Schumer wants to ban lots of useful things, like energy drinks, high-frequency stock trading, free-market wages and 3-D printers that can make guns.

So I’m glad Overstock.com and other businesses are out there, reminding people that law-abiding citizens use Bitcoins to buy legal things. Last month, I used them to buy Christmas gifts.

But Bitcoin’s legitimacy shouldn’t depend on whether people do things with it that politicians consider wholesome. When government restricts drugs, online gambling and other popular activities, it just makes anonymous, hard-to-trace currencies more popular.