In my latest book, The Real Crash: America’s Coming Bankruptcy – How to Save Yourself and Your Country, I devote a full chapter to the merits of the historical gold standard and reasons to reinstate it. What I did not mention and few investors notice is that central banks are already returning to gold as the ultimate safe haven asset.

I believe this change in policy, combined with continued inflation of Western currencies, is creating a stable floor for the gold price and an even brighter upside potential.

A Strategic Shift

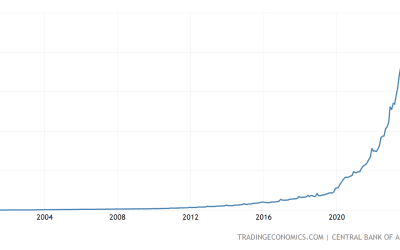

The return to gold is unmistakably the product of a strategic, not merely a tactical, shift in global central banking policy. Central banks in the developed world have now altogether stopped selling bullion. This was foreshadowed by their behavior over the past decade, when they sold even less gold than they were permitted to under the anti-dumping Central Bank Gold Agreements. Clearly the concern about dumping gold was out of step with the trend. But more importantly, central banks in the emerging markets have been buying gold by the truckload.

Since the financial crisis of ’08, nations as diverse as Mexico, the Philippines, Thailand, Kazakhstan, Turkey, Ukraine, Russia, Saudi Arabia, and India have led the way back to gold as a primary reserve asset. Russia alone has added an impressive 400 tonnes of bullion to its reserves, most of it coming from domestic purchases. Mexico has added over 120 tonnes, including 78 tonnes from one mega-purchase in March 2011. The Philippines have bought over 60 tonnes, with 32 tonnes coming in as recently as March 2012. Thailand has added approximately 60 tonnes, and Kazakhstan just shy of 30 tonnes. Turkey amended its regulatory policy late last year to allow commercial banks to count gold towards their reserve requirements, adding over 120 tonnes to its official reserves. And bullion imports into mainland China through Hong Kong have been reaching all-time highs.

Finally, loyal US allies Saudi Arabia and India, in what is sure to leave particularly bitter taste in Washington’s mouth, have been adding gold to their reserves by the hundreds of tonnes.

In short, the governments of emerging markets recognize that the global monetary order is on the verge of a reset. These emerging markets are the economic engines of the 21st century, and they’re determined not to be undermined by Western fiat paper.

Taking the Long View

The depth of this new strategy has been on display throughout the precious metals correction of the past few months. Emerging market central banks have continued to be aggressive buyers. This is very bullish. As governmental actors, central banks seek out stability and predictability. When they shift course, they do so only deliberately and gradually, much like aircraft carriers. Western central banks have set a clear course toward inflation, while emerging market banks are shifting toward sound money.

The implications here are enormous for private investors. We now see the biggest market participants buying the yellow metal massively on the dips. What’s more, because central banks enjoy substantial clout in the gold market, their purchasing decisions have an outsized effect on price. Institutional investors are coming to once again see precious metals as a ‘legitimate’ form of investment. It is this positive feedback loop that will serve to stabilize gold as it re-emerges as a reserve asset.

It’s Still The One

Gold remains the bedrock of reserve holdings at central banks, even in a world dominated by fiat currencies. Apparently, when it comes to a paper-based global monetary system, it’s easier to talk the talk than walk the walk. Government officials the world over, but especially in the developed world, have been quick to call gold an anachronism – unsuitable for a modern, globalized economy. But these same governments have never found it in themselves to sell off their holdings, or for that matter, to surrender even a substantial fraction of them. Those who have clamored the loudest have, in fact, behaved the most conservatively.

The US, which has a whopping 75 percent of its reserve holdings in gold, and the Western European countries, which have an average of approximately 64 percent of their reserve holdings in gold, seem to believe no one should own gold – except them! It shouldn’t surprise anyone that emerging market central banks have spotted the double standard. As they advance economically, these nations are less likely to do what Washington tells them is right and more likely to think for themselves. And with an average of less than 20 percent of their reserve holdings in gold, they clearly know they have some catching up to do.

Behind the smoke and mirrors then, central banks in the developed world are hoarders. Central banks in the emerging markets are scramblers. Significantly, nobody is selling, only buying.

The Fiat Fantasy Meets Reality

What is causing the rush back to gold? Two words: excess debt. Independent central banking has always been more of a dream than a reality. Politicians knew from the beginning that they could run up the tab and then corner central bankers into bailing them out via inflation, AKA stealth default. Regrettably, central bankers have dutifully obliged – no one, for example, has yet resigned in protest. Only a few have ever defied their governments, and only for short periods.

Of course, governments throughout history have created the conditions for their own collapse by tampering with their money supply to pay debts. Undermining the currency means undermining the entire economy, which lowers tax receipts and creates more debt. Soon, the unintended consequences of the policy overwhelm its intended consequences, and the state collapses – along with the jobs of those central bankers. Committed, nonetheless, the central bankers are.

Valuation Insurance

Against this historical cycle, the best insurance policy is physical gold. Those with the most of it will best weather the coming rounds of competitive devaluation. No wonder that central banks in the emerging markets are scrambling to play catch up to their developed-world counterparts.

How much gold will central banks stockpile? We cannot and do not know for sure. What we can and do know for sure is that they have prudently decided on a strategic shift in policy. This is creating a floor for the price of gold and a brighter future ahead for those who are prepared for the return of sound money.