John Allison’s testimony before the Subcommittee on Monetary Policy and Trade, Committee on Financial Services, United States House of Representatives on March 16, 2017.

Chairman Barr, ranking Member Moore, and members of the committee, thank you for inviting me to testify about sound monetary policy. The following are excerpts from my 2012 book called The Financial Crisis and the Free Market Cure: Why Pure Capitalism is the World Economy’s Only Hope, which I believe best represent my views on how the Fed’s monetary policies caused the Great Recession, distort markets, and harm the ability of American firms and families to reliably plan for the future.

***

“In a simple (but fundamental) sense, the only way there could have been a bubble in the residential real estate market was if the Federal Reserve created too much money. It would have been mathematically impossible for a misinvestment of this scale to have happened without the monetary policy of the Fed. In 1913, the monetary system in the United States was nationalized. The federal government owns the monetary system. We do not have a private monetary system in the United States. Problems in the monetary system were the source of the current Great Recession. If there are problems in the monetary system, they are, by definition, caused by the federal government, because the federal government owns the monetary system.

If interstate highway bridges were falling down, most people would realize that since the interstate highways are owned by state and federal governments, the problem was essentially caused by government decisions. Even if a bridge contractor did not use the right materials, government highway agencies select the contractor, inspect the materials, and so on. This would be particularly true if many bridges were falling down and these bridges had been built by different contractors.

It would then be clear that something was wrong with the government highway agencies’ specifications, selections, procedures, inspections, and other actions. In the last several years, monetary highway bridges have been falling down all over the place.

The Federal Reserve owns and controls the monetary system in the United States. The Federal Reserve is theoretically an independent government agency. However, the president appoints the members of the Federal Reserve Board with the approval of Congress. While some members of the board are qualified, many appointments are driven primarily by political considerations. As with many government appointments, it is very unlikely that an individual who does not fundamentally agree with the existing role of the Fed will be appointed. This makes it difficult for the board to have a broad base of different economic perspectives and means that the board is strongly influenced by the political environment.

Many members of the board (regardless of their professional backgrounds) are political in nature or they would not have gone through the political process necessary for their appointment. The banking industry has one appointment position on the board. In my 40-year career, the industry has never been represented by the best and brightest bankers. The industry is typically represented by politically connected bankers. While in theory, the Fed has a dual role of maintaining both stable prices and low unemployment, I have had numerous private conversations with board members over the years in which they readily admitted that the political pressure is to maintain low unemployment, not stable prices. We will discuss the significant long-term implication of this political pressure.

In theory, the Federal Reserve was created to reduce volatility in the economy. In fact, the Federal Reserve reduces volatility in the short term, but increases volatility in the long term. In a free market, because human beings are not omniscient, markets are constantly correcting. Poorly run businesses for which customer demand has changed, go out of business, and new businesses that do a better job of meeting consumer demand are created. A free market is in constant correction. It is always searching for the best way to produce goods and services at the lowest cost and of the best quality.

When the Federal Reserve steps in and uses monetary policy to stop the downside correction process, all it achieves is to defer problems to the future and make them worse. Its action delays and distorts the natural market correction process, thereby reducing the long-term productivity of the economic system by encouraging a misuse of capital and labor. One of the best ways to view free markets is as a great number of experiments that are being conducted simultaneously. Most of the experiments are failures. However, every failure contributes to the learning process. Thomas Edison noted that the 1,000 apparently failed experiments that led to the lightbulb were, in fact, absolutely necessary. For every Google or Microsoft, there are 1,000 failures, all of which are in a certain sense necessary.

By the way, the argument for the Federal Reserve is that there were significant economic corrections in the 1800s and government needed to provide stability to banking. Interestingly, the United States created two quasi-central banks in the 1800s, both of which effectively failed. (One of the great debates at our founding was between Jefferson and Hamilton on this issue.) Most banks, however, were state-chartered. The state banks were not any less political than the federally regulated banks. One of the major reasons for failures of state-chartered banks was that they were required to purchase state-issued bonds that typically financed the expansion of railroads. Many of the rail roads were built by crony capitalists who had powerful political contacts and did not know how to run a railroad. The railroads failed, then the state bonds failed, and then the banks failed. Still, U.S. government surpluses were the norm during this period, and the national debt declined steadily from 30 percent GDP in 1869 to just 3 percent in 1913. Downturns during the Gilded Age (1865-1913) were less common and less severe than economists once believed.

Before the Federal Reserve, and despite these problems, in the late 1800s and early 1900s, the United States experienced a phenomenal growth rate while absorbing a huge inflow of immigrants with very limited skills. Most economic corrections during this period, while sometimes deep, were short, and the economy quickly regained steam. Government debt was low, and the future was not mortgaged (as it is today). There was nothing close to the economic devastation of the Great Depression. It is interesting that the Federal Reserve will now, finally, admit that its policies played a significant role in causing the Great Depression, even though this fact was established decades ago by Milton Friedman. In other words, without the Federal Reserve, we would not have had a Great Depression.”

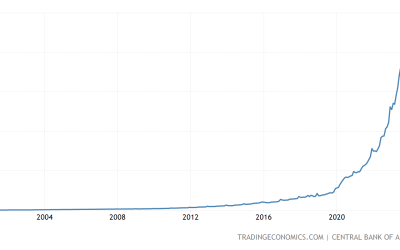

“The fact that the federal government (via the Treasury and the Federal Reserve) can “print” money allows Congress to undertake many programs that accumulate debt (and buy votes) and motivates the Fed to constantly try to inflate the money supply, undermining the trustworthiness of the value of the money. Markets are always aware of this risk and are constantly trying to figure out when the Fed will begin to debase the currency again. The fact that the Fed can debase the dollar anytime it wants to makes investing in dollar-denominated assets more risky. If a business undertakes the development of a long-term project, it may face higher input costs than it expects if the Fed decides to start inflating the currency. The business cannot know which will rise more, its cost of production or the sales price of its products, because inflation does not affect all prices evenly.

This has been a particularly significant problem in recent years because the Federal Reserve has undertaken a massive expansion of the money supply. If the economy begins to improve and the Fed does not withdraw the tremendous reserves it has created from the banking system, rampant inflation will follow. If it does withdraw the reserves quickly, interest rates will rise rapidly. This situation makes economic calculations extremely difficult and makes businesses less willing to invest, especially for the long term. If business owners could fully trust the Fed, this would not be an issue, but we have all been burned too many times to trust the Fed.”

“In my career, the Fed has a 100 percent error rate in predicting and reacting to important economic turns, which is not surprising. It is trying to arbitrarily set the single most important price in the economy–the price of money. This price affects every economic decision. What is interesting is that the economists at the Fed know that bureaucratic price setting is a total failure. They have observed this phenomenon in all socialist and communist economies. They would not claim the ability to set the right price for an automobile, but they somehow believe that they can establish the proper interest rate for a highly complex economy in a globally integrated environment.

On several occasions, I have asked members of the Fed Open Market Committee (who set interest rates) whether they believed in price fixing. They all emphatically said no. Then I asked them why they believed that they had the ability to set the price of money. Their response was effectively that the price of money (interest rates) is different. Why? No answer. I said earlier that the Federal Reserve economists are intelligent. They are, but they have a specific kind of intelligence. They have a detached-from-reality, academic, floating abstraction form of intelligence. This type of intelligence thrives on mathematical reasoning, but has difficulty dealing with nonmathematical phenomena, such as the impact of intangible incentives on human actions. They are surprised (continually) that individuals do not act the way their models say they should. Of course, if they were truly intelligent, they would realize that their task is impossible and recommend a market-based monetary system”

***

Thank you again for the opportunity to testify today and I look forward to answering your questions.