This article is excerpted from chapter 20 “Toward The Establishment of Laissez-Faire Capitalism” from George Reisman’s Capitalism: A Treatise On Economics (1996). See the Amazon.com author’s page for additional titles by Dr. Reisman.

The establishment of gold as money is essential to the achievement of a capitalist society. (What is said concerning gold, of course, also applies to silver. Furthermore, for reasons explained in the last chapter, the gold or silver money I speak of should be understood as a 100- percent gold or silver money–i.e., a 100-percent-reserve system–in which, apart from subsidiary token coinage, all money either literally is gold or silver or is receipts for gold or silver that are fully backed by same.)

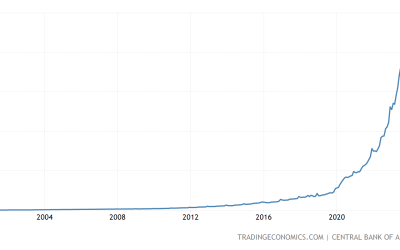

The establishment of gold as money on these terms is necessary in order to end inflation and all of its destructive consequences. It is necessary in order to take the power to inflate–that is, to create money virtually out of thin air–out of the hands both of the government and of the banking system operating with the sanction of the government. It is necessary in order thereby to subordinate the government to the financial power of the citizens and to make people aware of the cost of government spending, and to end the arbitrary redistribution of wealth and income, the undermining of capital accumulation, the possibility of utter economic devastation either through wage and price controls or the ultimate destruction of money, and deflation, depression, and mass unemployment. It is also necessary for making possible the rapid and radical dismantling of the welfare state, by removing the threat of depression as an accompaniment of that process.

Because I have thoroughly discussed the role of gold and the methods for achieving a gold standard in the last part of the previous chapter [Chapter 19 of Capitalism: A Treatise On Economics.], I will say no more about this vital subject here. However, it had to be named here at least to this extent.

Articles in this Series

- Toward the Establishment of Laissez-Faire Capitalism (Part 1 of 10)

- Privatization of Property: Importance of Fighting on Basis of Principles (Part 2 of 10)

- The Freedom of Production and Trade Under Capitalism (Part 3 of 10)

- Capitalism and the Abolition of the Welfare State (Part 4 of 10)

- Abolition of Income and Inheritance Taxes Under Capitalism (Part 5 of 10)

- Establishment of Gold as Money (Part 6 of 10)

- A Pro-Capitalist Foreign Policy (Part 7 of 10)

- Separation of State from Education, Science, and Religion (Part 8 of 10)

- A General Campaign at the Local Level for Laissez-Faire Capitalism (Part 9 of 10)

- The Outlook for the Future of Capitalism (Part 10 of 10)

Copyright 1996 George Reisman. All rights reserved. The encyclopedic Capitalism: A Treatise on Economics is a required reference for every Capitalist’s library. Reisman’s treatise is now available in two volumes: Volume I (focuses on microeconomic issues) and Volume II (focuses on macroeconomic issues).