Imagine standing on the beach with a small child. You spot a large sea creature with a protruding dorsal fin. The child is frightened and says, “Look, daddy, a shark!” You look carefully and reply, “No, son, that’s a dolphin; it won’t hurt you.” But the child has just watched “Shark Week” for the first time, and this sure looks like a shark to him! In the child’s mind, If they look the same, they must be the same. Lacking the knowledge that sharks and dolphins are fundamentally different animals, your child cannot know if it’s safe or if he is in shark-infested waters.

A similar ignorance blurs the distinction between commercial banks and other financial institutions. The ignorance persists because very few people understand how banks create money. As I’ve previously written, money creation is a “black hole” in the universe of economic knowledge. Practically no one understands it.

The widespread ignorance of money creation has never been more evident than during the recent failure of Silicon Valley Bank (SVB). Nearly all financial writers portray commercial banks as financial intermediaries rather than money-creators, thus relying on a false model to explain how banks like SVB work. The misunderstanding extends beyond children to include educated adults, political pundits, financial journalists, and even professional economists. Let’s dive in to see the nature of the error, why it persists, and why it matters to you.

To illustrate, here’s a passage from a March 13 Bloomberg article analyzing the SVB failure (emphasis added):

“The way a bank works is that it borrows short to lend long. Simplistically, a bank might get its money from demand deposits, checking, and savings accounts that customers can withdraw at any time. And the bank might pay, say, 0% interest on those deposits. And then it invests the money in some longer-term assets, loans and bonds that don’t get paid back for years, and that pay, say 2% interest …”

The author says banks invest the money acquired from customer deposits. He says a bank “borrows” customer deposits (which can be withdrawn at any time by the deposit owner, at par value) and uses this money to make loans or buy bonds, both being examples of “longer-term assets.”

The Bloomberg article is only one of the dozens depicting banks this way, that is, as “financial intermediaries” that invest other peoples’ money. But they are all wrong. Banks do not invest their depositors’ money, nor do they invest the bank’s cash reserves.

If you are skeptical about that statement, you should continue reading to the end.

To demonstrate how banks really work, let’s compare the development of two bank balance sheets as they receive deposits and make investments. The first example is from an entity I’ll call Fake Bank because it operates just as the Bloomberg article describes, even though actual banks don’t work this way. Then we’ll compare the results to Real Bank, which operates according to the real world of money and banking.

In Fake Bank, we start with a customer deposit of $100, which is recorded on the liabilities side of the balance sheet as $100 in “deposits.”

On the asset side, we record the deposit as $100 in “cash reserves.” (When the Bloomberg article says the bank “invests its customers’ deposits,” it means it is investing these cash reserves.)

Next, suppose Fake Bank invests $40 of these cash reserves in long-term bonds and $40 in long-term loans. That leaves $20 in cash reserves to cover regular withdrawals. Fake Bank’s balance sheet would then look like this:

The total assets and liabilities on the balance sheet stayed the same after Fake Bank made its investments. The bank merely swapped cash reserves for loans and bonds, just as any person or corporation might swap cash for shares when buying stock or spending cash money for a new car. This cash-for-assets transaction is precisely what the Bloomberg article described.

But wait, this is Fake Bank. Real banks do not spend their cash reserves on investments. Let’s look at how Real Bank’s balance sheet changes when it makes loans and buys bonds.

We start with the same initial condition: Real Bank receives $100 in customer deposits and records these deposits on the asset side as cash reserves. So far, the balance sheet of Real Bank looks the same as that of Fake Bank.

Next, Real Bank makes the same investment: $40 in loans and $40 in long-term bonds.

Attentive readers will notice that Cash Reserves did not change but remained at $100, just as before the investments were made. That’s because banks do not (and cannot) invest their cash reserves. Notice also that the balance sheet increased on both the asset and liability side by the same amount as the total $80 investment. The bank created new money, i.e., deposits – $40 in the bond sellers’ accounts and $40 in the borrowers’ accounts.

The ability to create money differentiates commercial banks from all other financial institutions. The Bloomberg article describes how some other financial institutions operate, but not banks. Creating new money in this way is a legal privilege given only to commercial banks, and it is how new money is created in all modern economies.

If you are surprised by the assertion that banks create money as I have described, I refer you to my many articles and podcasts on the process. Here, here, and here are a few examples.

Don’t just take my word for it. There are many good sources. For example, here are some excerpts from an authoritative source, the Bank of England Quarterly Bulletin, Q1 2014:

“The reality of how money is created today differs from the description found in some economics textbooks: Rather than banks receiving deposits when households save and then lending them out; bank lending creates deposits.”

“Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.”

I recommend reading the entire article, which is concise and clearly written.

More references to money creation are listed at the end of this article. I recommend them all, especially those by the eminent Richard Werner.

It’s worth asking why practically every financial commentator gets the description of banking wrong. Why do so many believe commercial banks invest the cash reserves that come with customer deposits? There may be many reasons, but a leading one is that the myth of “banks as intermediaries” is plausible because it explains some things we observe. We observe a run on deposits in a commercial bank, then observe that the same thing can happen to other financial institutions, then mistakenly assume these institutions are essentially the same.

A “run,” or similar, can happen to any financial institution with mismatched assets and liabilities. Indeed, a run on deposits is not confined to commercial banks. Even a money market fund (a financial intermediary that does invest customers’ deposits) can experience a “run on the bank” in which the depositors do not get all their money back. The same is true of life insurance companies and pension funds. If the performance of their assets is poor, or if their liabilities come due unexpectedly, their balance sheets can become insolvent.

So while it’s true that an asset-liability mismatch can cause both commercial banks and financial intermediaries to fail, the two are very different entities. Just as a dolphin is not a shark, a money-creator is not a financial intermediary.

But inaccurate descriptions like the Bloomberg article encourage you to think of banks as intermediaries, obscuring their unique role as money creators. That’s regrettable because understanding how banks create money can help you protect your savings and investments.

For instance, understanding money creation will teach you that credit creation in banks has remained the same for hundreds of years. Even under the gold standard, most circulating money came from bank credit in paper banknotes or checking deposits. However, under gold, the quantity and quality of new money creation were regulated by those who deposited their gold in the banks, not bureaucrats or politicians. So, you can decide for yourself whether our current fiat money system is risky or if you should try to distance your investments from it.

The history of money creation will tell you that until the early 20th Century, economists and bankers understood how banks used credit creation to increase the money supply. But this knowledge was largely lost during the 20th Century, replaced by Paul Samuelson’s specious presentation of fractional reserve banking, followed by the currently popular but incorrect financial intermediation theory. (see Richard Werner, “A Lost Century in Economics.”) Knowing this will put you ahead of most professional financial writers, allowing you to see through their confusing descriptions of money and banking.

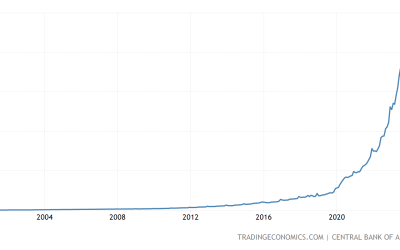

Understanding money creation allows you to see that central banks work similarly to privately-owned commercial banks, except that central banks create both new cash reserves and new bank deposits “ex nihilo” when they purchase financial assets from private investors. Knowing this, you can understand how central bank programs like Quantitative Easing can directly impact the value of your investments.

Most important, If you understand money creation, you can know that there is both “good” money creation and “bad” money creation. Good money springs from sound investment decisions by banks to fund productive enterprises that generate real economic growth. Good money creation is non-inflationary and promotes economic progress.

On the other hand, bad money creation stems from unsound investment decisions, most often caused by poor regulation, political pressure, cronyism, and the sway of collectivist ideologies. Bad money creation finances unproductive projects, asset bubbles, consumer price inflation, wasted capital, wasted time, misallocated purchasing power, and unjust wealth distribution. For a leading example of bad money creation, see the Fed’s 13-year experiment in Quantitative Easing from 2009 to 2022.

Knowing the difference between good and bad money creation allows you to take appropriate action when, as today, bad money creation seems to dominate public policy.

Although accurate knowledge of money creation is uncommon, it is easy for any interested person to acquire. Take the time to learn about it, as its consequences are far-reaching and ultimately will affect you personally.

The references in the reading list below should be helpful.

Articles

- Money Creation, Then And Now One good way to understand the current monetary system is to gain a basic understanding of banking history.

- Money Creation: Who Cares? Commercial banks do not lend out other peoples’ money. On the contrary, banks create new money every time they make a loan.

- Money Creation In The Modern Economy, 2014 Q1, Bank of England Quarterly (don’t miss this one)

- A Lost Century In Economics, 2016, Richard Werner (Professor Werner is the most significant living monetary economist, in my view. The article references much of Werner’s other valuable work.)

- Examining Modern Money Creation, 2022, Andrew Hook, Sussex University (Professor Hook offers insight into the structure of the monetary system and provides data proving the widespread ignorance of money creation.)

- Repeat After Me: Banks Cannot And Do Not ‘Lend Out’ Reserves, 2013, Standard & Poor’s RatingsDirect (a thorough explanation of bank reserves)

Books

- Where Does Money Come From? 2012, Josh Ryan-Collins, Richard Werner, et al. (This is the only textbook I would recommend for a class in money and banking.)

- The Case For People’s Quantitative Easing, 2019, Frances Coppola (Although I emphatically do not endorse Coppola’s money-printing proposals, I recommend reading her book because she clearly explains how central banks use commercial banks to create money. Read it to learn how central banks can abuse money creation.)