This talk examines the development, operation and performance of monetary systems in the absence of government intervention. Topics covered include the spontaneous evolution of money, the rise of banks, bank self-regulation under competition and crisis management in the absence of a central bank. Recorded at OCON 2015.

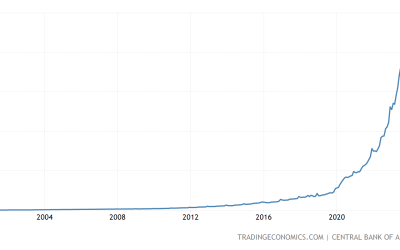

Argentina’s Rampant Inflation, Explained in One Chart

Whichever definition one prefers to use — an expansion of the money supply which leads to price increases, or a broad and sustained increase in consumer prices — inflation is caused by the governments and central banks who control the money supply.