The government may think that inflation–as a method of raising funds–is better than taxation, which is always unpopular and difficult. In many rich and great nations, legislators have often discussed, for months and months, the various forms of new taxes that were necessary because the parliament had decided to increase expenditures. Having discussed various methods of getting the money by taxation, they finally decided that perhaps it was better to do it by inflation.

But of course, the word “inflation” was not used. The politician in power who proceeds toward inflation does not announce: I am proceeding toward inflation.” The technical methods employed to achieve the inflation are so complicated that the average citizen does not realize inflation has begun.

One of the biggest inflations in history was in the German Reich after the First World War. The inflation was not so momentous during the war; it was the inflation after the war that brought about the catastrophe. The government did not say: “We are proceeding toward inflation.” The government simply borrowed money very indirectly from the central bank. The government did not have to ask how the central bank would find and deliver the money. The central bank simply printed it.

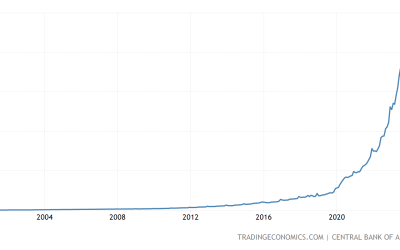

Today the techniques for inflation are complicated by the fact that there is checkbook money. It involves another technique, but the result is the same. With the stroke of a pen, the government creates fiat money, thus increasing the quantity of money and credit. The government simply issues the order, and the fiat money is there.

The government does not care, at first, that some people will be losers, it does not care that prices will go up. The legislators say: “This is a wonderful system!” But this wonderful system has one fundamental weakness: it cannot last. If inflation could go on forever, there would be no point in telling governments they should not inflate. But the certain fact about inflation is that, sooner or later, it must come to an end. It is a policy that cannot last.

In the long run, inflation comes to an end with the breakdown of the currency; it comes to a catastrophe, to a situation like the one in Germany in 1923. On August 1, 1914, the value of the dollar was four marks and twenty pfennigs. Nine years and three months later, in November 1923, the dollar was pegged at 4.2 trillion marks. In other words, the mark was worth nothing. It no longer had any value.

Some years ago, a famous author, John Maynard Keynes, wrote: “In the long run we are all dead.” This is certainly true, I am sorry to say. But the question is, how short or long will the short run be? In the eighteenth century there was a famous lady, Madame de Pompadour, who is credited with the dictum: “Apr