“It seems to me that our American partners are making a colossal strategic mistake (as they) undermine the credibility of the dollar as a universal and the only reserve currency today. They are undermining faith in it… They really are taking a saw to the branch they are sitting on… People think that nothing will happen, everything is so powerful, everything is so strong and stable, there will be no negative consequences. But, no, they come sooner or later.”

–Vladimir Putin, October 3, 2018

Uncle Sam’s eagerness to weaponize the dollar by canceling bank accounts is now front and center in US foreign policy. While the Treasury Department has historically used its legal authority to freeze bank accounts of bad actors like North Korea, Cuba, Iran, and Venezuela, its recent action against Russia is the mother of all banking sanctions. Besides closing US banks to Vladimir Putin and his oligarchs, as of February 28, the US Treasury has frozen the US dollar accounts of the Russian Central Bank.

“This is the nuclear option,” British historian Adam Tooze told the New York Times. (Ironically, Tooze sees sanctions against a central bank as the new nuclear option even though an actual nuclear war with Russia is possible.)

The unprecedented move means the US has denied the Bank of Russia access to its foreign reserves held in US banks, including those in the US Federal Reserve. The action says to Russia: The money owed to you and recorded in our banks is now null and void because the US government says so. The immediate effect is to prevent the Bank of Russia from using reserves to prop up its currency, the Ruble, which has fallen precipitously. Score one for the dollar.

Other objectives are not so easily met. Will this penalty convince Vladimir Putin to stop the invasion of Ukraine? Will it cause so much economic pain to the Russian people that they will rise and throw him out? These outcomes seem unlikely, as similar sanctions on more minor countries have not dislodged the tyrants there.

Whether the bank sanctions hurt Putin or not, they will have far-reaching effects on many innocent people, and not only in Russia. To understand these effects, consider what happens when a bank account is “frozen.”

In today’s monetary system, almost all money consists of a ledger entry in a bank. A buyer pays for goods by instructing his bank to subtract a specific number of dollars from his account and add this amount to the seller’s account. (That’s what happens when you write a check or pay with your debit card. For a refresher, See Money From Nothing.)

When a bank regulator or a judge orders a bank to stop taking instructions from the account owner, all money movement stops, and the account is frozen. Freezing doesn’t just harm the owner of the account. Many others also suffer in at least two ways. First, the community loses the benefit of any productive economic services provided by the target of the action. Second, if customers perceive the government’s shutdown order as arbitrary or heavy-handed, this will have a chilling effect on trust in the bank. After all, If the government can freeze your account for no good reason, it can do the same to mine.

These effects apply equally to both foreign and domestic customers of US banks. In the case of Russia, the impossibility of confining the costs of the shock to the “enemy” makes freezing bank accounts an activity worth reconsidering.

Putin and his oligarchs will not be the only casualties of bank account warfare. For example, legitimate Russian businesses, which supply much of the world’s oil, fertilizer, grain, and metals, will no longer be able to use a dollar-based banking system to trade with their customers. Their customers – tens of millions of people in Europe, Africa, and India – will no longer be able to buy and sell Russian goods priced in dollars. Both buyers and sellers will need to find an alternate payment system that allows them to survive.

Biden seems confident that the dollar’s dominance will make his sanctions work. Perhaps he thinks the world has no choice, as over 60 percent of all international trade, including nearly 100% of crude oil transactions, are in US dollars. The problem is that in using the dollar as a hammer, Biden risks breaking it.

The dollar’s ascent to the king of currencies was not, as some claim, a privilege bestowed on the nation that won World War II. Its climb to the top of the currency mountain was hard-won and well-deserved.

The dollar became the world’s reserve currency because you could buy practically anything with it – in America. For example, you could confidently buy or build a business anywhere in the 50 states, guaranteed by Constitutional law. You could live in a peaceful land protected by fair laws, honest police, and a Bluewater Navy. In America alone, the dollar’s geographical reach was enormous. The size and variety of the things you could buy with dollars in America were unmatched anywhere. Ethnicity, religion, or gender did not exclude you. Confidence in the country begat confidence in the currency, which begat confidence in trade, which begat more trade, in an unbroken circle.

In time, the dollar’s near-universal access to wealth made it the most marketable currency in history. Over many decades, this marketability gradually extended to the entire world. People in remote locations would accept greenbacks because even if they could never buy something American, there were always millions of others who could. Everyone in the world wanted American dollars for the same reason millions of foreign citizens immigrated to America: the possibilities in America seemed endless.

The same was never true of the Chinese Renminbi, the Russian Ruble, or even the Swiss Franc. There are no property rights in China, Russian law enforcement is thoroughly corrupt, and you can’t buy oceanfront property in Switzerland. Demand for these currencies was necessarily limited.

A free and flexible banking system was always the dollar’s indispensable right hand because a reliable banking system strengthens the dollar’s marketability.

Freedom in commerce sits at the root of the dollar’s appeal. Any banking restriction, including the freezing of accounts, may undermine this strength. In the vast network of the dollar-based banking system, it’s hard to target the bad guys without scaring off the good guys, especially when the bad guys are some of the biggest players.

As both friend and foe adjust to the dollar’s weaponization, what long-run effects should we, the good guys in America, expect to see?

First, expect a decline of the dollar’s reserve currency status as foreign governments, corporations, and entrepreneurs seek alternative payment systems.

The process is already underway. According to the Wall Street Journal, China and Saudi Arabia are discussing payment for oil in the Chinese Renminbi. “China buys more than 25% of the oil that Saudi Arabia exports. If priced in Renminbi, those sales would boost the standing of China’s currency.” Payment in Renminbi would be a radical move for both countries because Saudi Arabia has sold its oil for only dollars since 1974.

Russian Foreign Minister Sergei Lavrov expressed similar determination to eliminate dependence on the West’s banking system: “We will make sure we never find ourselves in a similar situation and that neither some Uncle Sam nor anybody else can make decisions aimed at destroying our economy.”

Some experts even think the Russians and Chinese will try to invent a new reserve currency, backed by commodities and gold. Notably, both the Russian and Chinese central banks have been among the largest buyers of gold in recent years.

Second, expect higher interest rates. China currently holds a massive $3.2 Trillion of US Treasurys resulting from its huge trading surplus. But why keep US Treasurys if the US might prohibit converting them to cash? Russia has sold down most of its Treasury bonds in recent years, replacing its foreign reserves with gold and other currencies. China could be the next big seller, pressuring interest rates higher.

Third, expect higher prices for everything because the supply of goods will be restricted even as the Fed continues printing money.

On the supply side, the move toward non-dollar payment systems will impair the international division of labor. Efficiency and productivity, accumulated over decades of liberalized trade and international cooperation, will suffer as countries join smaller trading blocs insulated by their currencies and separate agreements. As trading structures change, some supply chains will fail before they are rebuilt, resulting in more frequent shortages. The efficiency of “just in time” inventory management will yield to the security of “just in case” hoarding. Expect upward pressure on commodity and manufactured goods prices given the time required to adjust to new supply chains and demand patterns.

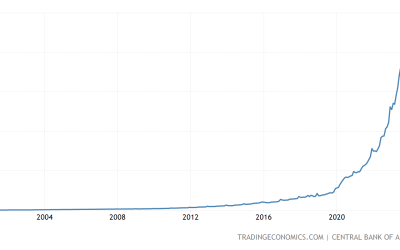

On the demand side, excess money creation will continue, fueling higher prices. HardmoneyJim readers are well aware of the inflationary effect of the money tsunami unleashed during the recent “Pandemic QE.” Although money-printing on that scale will slow down, it will not stop entirely because the US cannot avoid monetizing its growing national debt.

Fourth, expect the USA to eventually “re-shore” jobs and industries previously outsourced to other countries. The building of several new semiconductor plants in the USA is the first indication of this change.

Finally, economic stagnation and shortages may lead to social turmoil and violence. Record high wheat prices caused by the destructive Ukrainian war are a warning. The Arab Spring uprisings of 2011 started with rioters protesting high food prices in Cairo and Damascus.

Did Jo Biden choose to fight the Russians with the dollar because he thought the only alternative (a very bad one) was spilling American blood in Ukraine? But these were not his only alternatives. We have to wonder: Did he carefully consider the potential collateral damage – not just to the Russians, but to Americans and to the dollar itself – before choosing the “nuclear option”?